Pioniere der digitalen Zukunft. Von der Idee zum Markterfolg. AVA-X entwickelt hochmoderne KI-Produkte: Sentinel für fortschrittliche Gesichtserkennung und Zugangskontrolle, IRIS für essentielle Gesichtserkennung und Heliospan für tiefe Verarbeitung natürlicher Sprache. Unsere Lösungen, die sich durch Schweizer Präzision auszeichnen, erfüllen branchenübergreifende Anforderungen von Sicherheit über Sport bis hin zu humanitären Einsätzen. Sentinel bietet biometrische Zugangskontrolle, IRIS unterstützt Sicherheitsbehörden bei Ermittlungen und Heliospan meistert die Analyse unstrukturierter Datenmengen mit fortschrittlicher NLP-Technologie. Deepico revolutioniert die Lebensmittelindustrie mit Cloud-ERP-Lösungen, die Effizienz und Produktivität steigern. Unsere Technologie adressiert nicht nur digitale Transformation, sondern setzt auch auf Nachhaltigkeit und die Reduzierung von Lebensmittelverschwendung, um eine verantwortungsvolle Zukunft zu gestalten. Spectra macht Online-Publishing noch einfacher und schneller. Die dynamische Organisation des Contents ermöglicht ein neuartiges Kundenerlebnis. Dank intuitiver Bedienung und differenzierter Paywall ist Spectra die Zukunft des Online-Publishing. Mit eSports Technology entwickeln wir verschiedene Plattformen und Spiele im stark wachsenden E-Sports-Bereich. Erste Projekte sind die Weiterentwicklung der “Gameturnier”-Plattform und die Smartphone-App Freekickerz. Sind Sie an weiteren Informationen zu unseren Ventures interessiert? Kontaktieren Sie unseren Deep Impact Ventures

Deep Impact prägt aktiv die digitale Zukunft durch eigene Ventures. Mit technischem Know-how und visionärem Denken verwandeln wir innovative Ideen in erfolgreiche digitale Unternehmen.

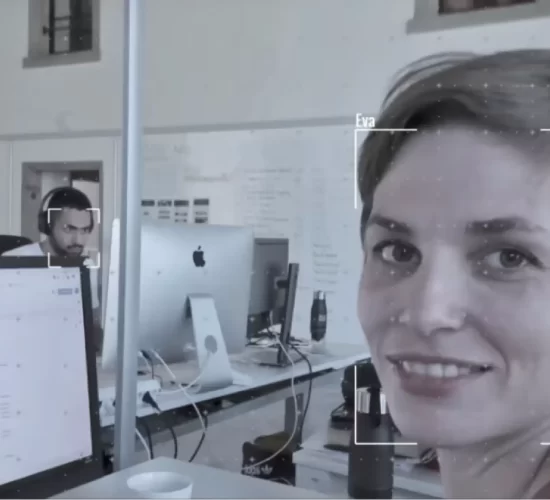

AVA-X: Pionier in KI-basierter Sicherheit und Datenanalyse

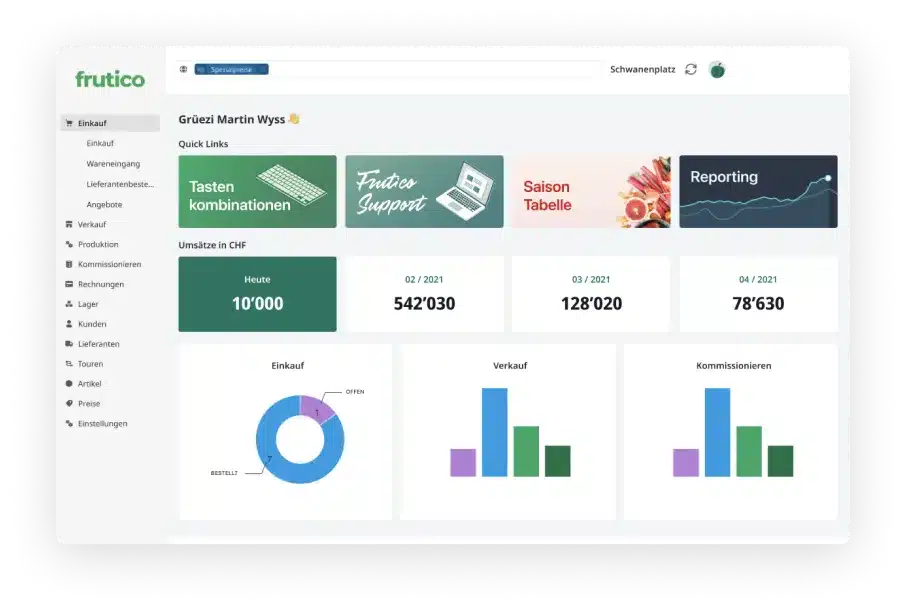

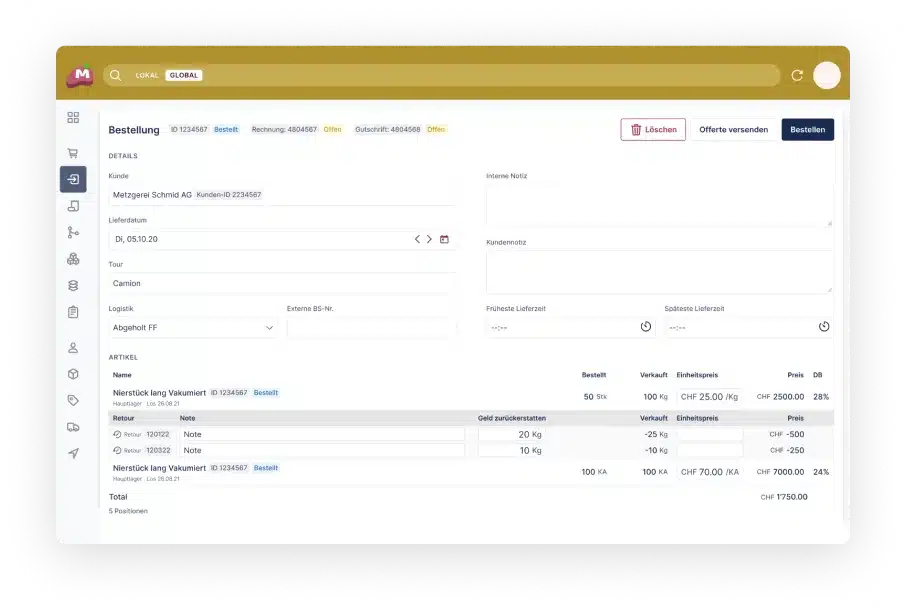

Cloud-ERP-Innovation für die Nahrungsmittelbranche

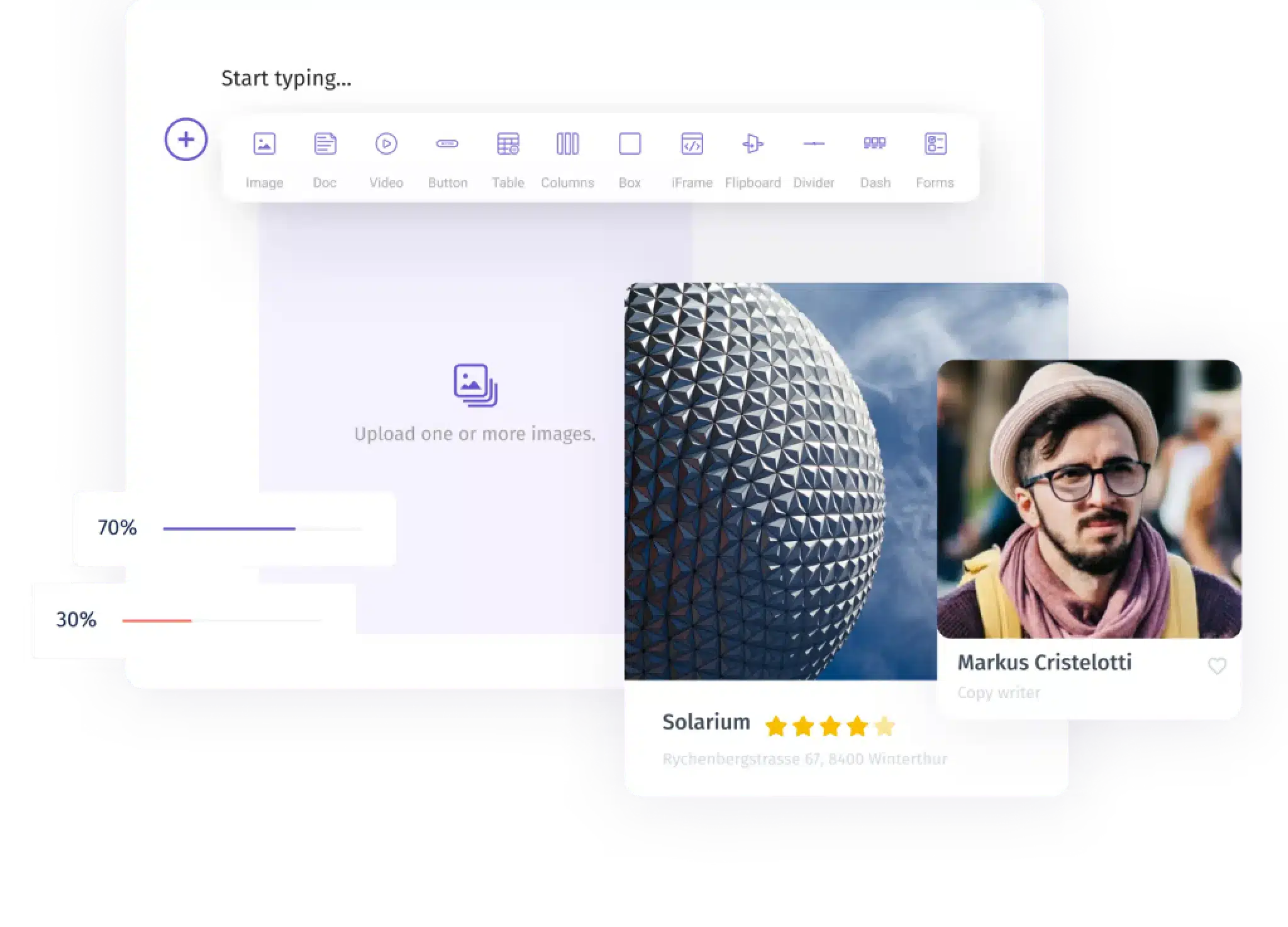

Online-Publishing

eSports Technology GmbH

Topmoderne E-Gaming-Plattformen

Investor Relations

Spannende Investionsmöglichkeiten.

CEO, Christian Fehrlin!